Instant Refunds Without the Margin Hit: How Leading DTC Brands Get It Right [+ Examples]

Amazon rewrote the rules of refunds.

Shoppers today expect the same speed and simplicity from every online store, whether it’s a billion-dollar marketplace or a mid-sized DTC brand.

Instant refunds have quietly replaced free returns as the new standard. Many brands now offer instant refunds by default to speed up resolution and keep repeat buyers from dropping off.

But without the right checks in place, offering instant refunds risks eating into revenue and rewarding risky behavior.

Meanwhile, refund volume is climbing. According to recent data, nearly 39% of consumers now return items bought online at least once a month.

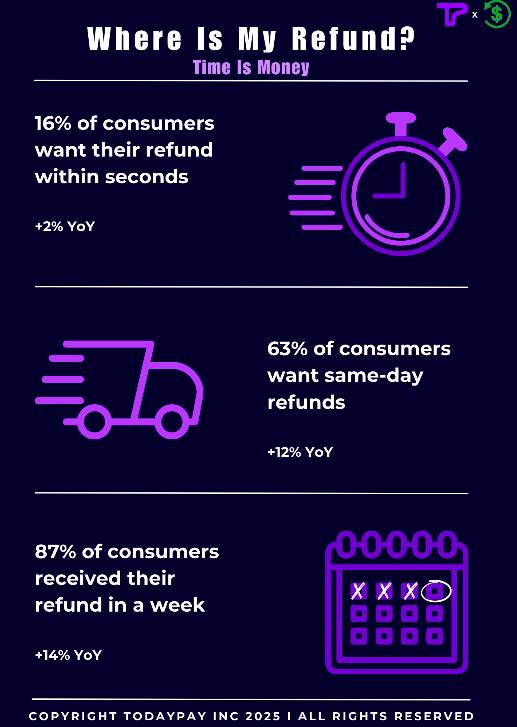

And 63% of shoppers in the US expect their refund the same day they return an item.

In fact, before they even click “buy now,” most shoppers check how easy it’ll be to return something and how quickly they’ll get their money back.

This behavior is also widely seen in Europe, with 77% of shoppers weighing in on return policies before buying. In the UK, slow refunds are costing brands:

- 30% are spending less online due to refund delays

- 52% say they won’t shop again if they have to wait too long for their refund money

That’s why the refund policy is becoming a boardroom conversation. It sits at the intersection of finance, CX, and retention.

Brands need to give shoppers the confidence to convert while staying in control of margin and risk.

- Instant refunds improve loyalty, but move too quickly and you risk refunding products that are never returned or returned damaged

- On the other hand, slowing things down frustrates loyal customers and creates an unnecessary support load

So what’s the smarter move?

This post makes the case that instant vs. delayed refunds is the wrong question. The better path is dynamic refund decisioning, giving teams the tools to respond based on risk signals, not fixed rules.

Think: fast refunds for your best customers, holds on flagged items, and smarter flows that protect revenue without creating friction.

Whether you’re a CFO looking to reduce losses or a CX lead trying to fix refund friction and build better post-purchase experiences, this guide will help you rethink how refund policies are set, who should get what, and when.

This is what we’ll cover:

- The refund dilemma facing ecommerce brands

- Instant refunds: excellent for CX, risky for margins

- Delayed refunds: lower risk, higher friction

- The true cost of refund processing for merchants

- Why one refund policy doesn’t fit all

- How dynamic refund decisioning changes the game

- How Supermoon helps refund teams act fast without losing control

The refund dilemma facing ecommerce brands

What used to be a backend process is now front and center in buying behavior. Consumers are not just scanning for free shipping; they’re actively choosing merchants based on refund timelines.

Research shows 92% of US shoppers say they’re more likely to complete a purchase if they know they can get a refund (no questions asked). Nearly 4 in 5 say they would spend more per order under those conditions.

Refund confidence is now a conversion lever, not just a support task.

Having said that, refund trust comes at a cost.

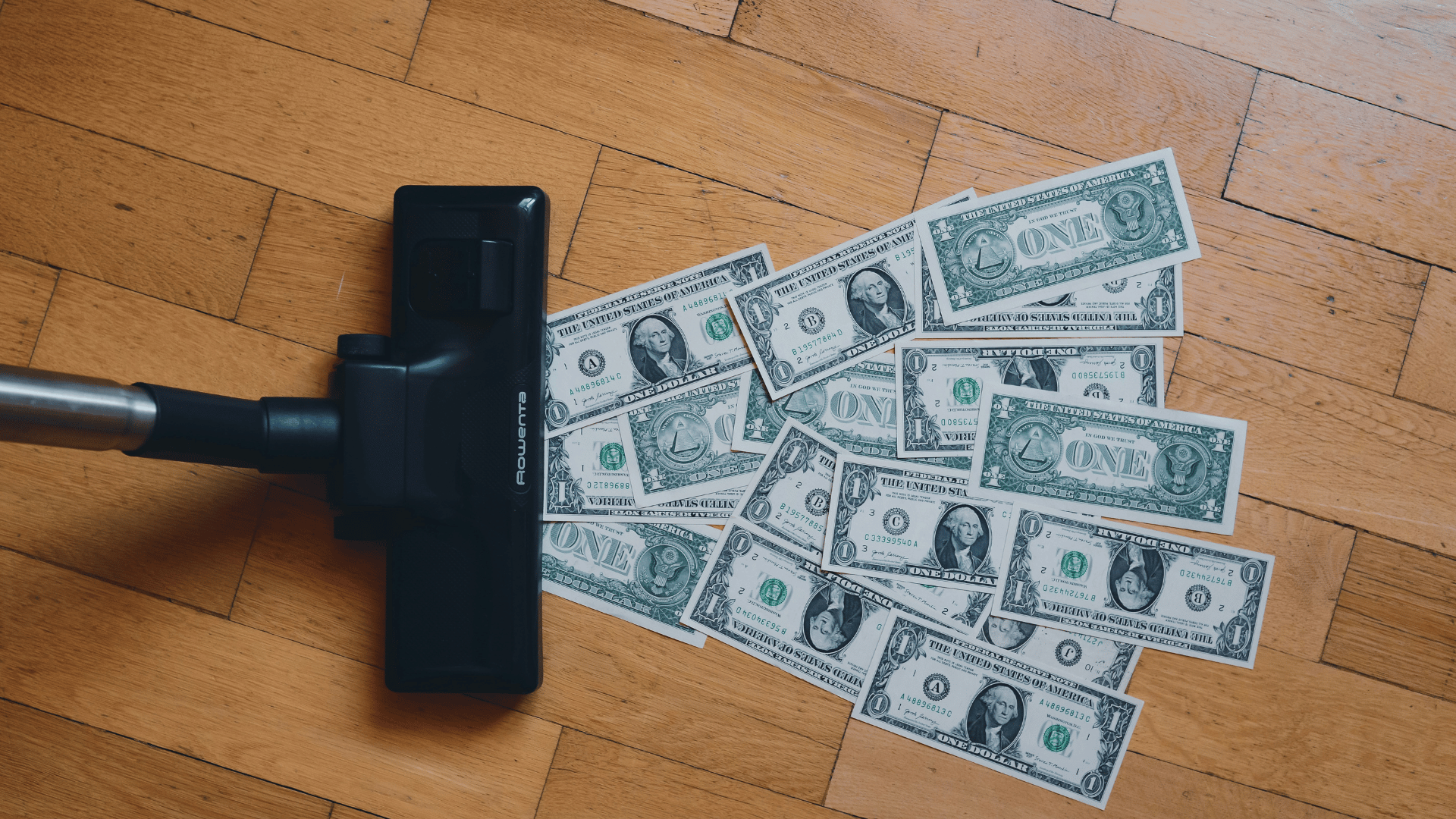

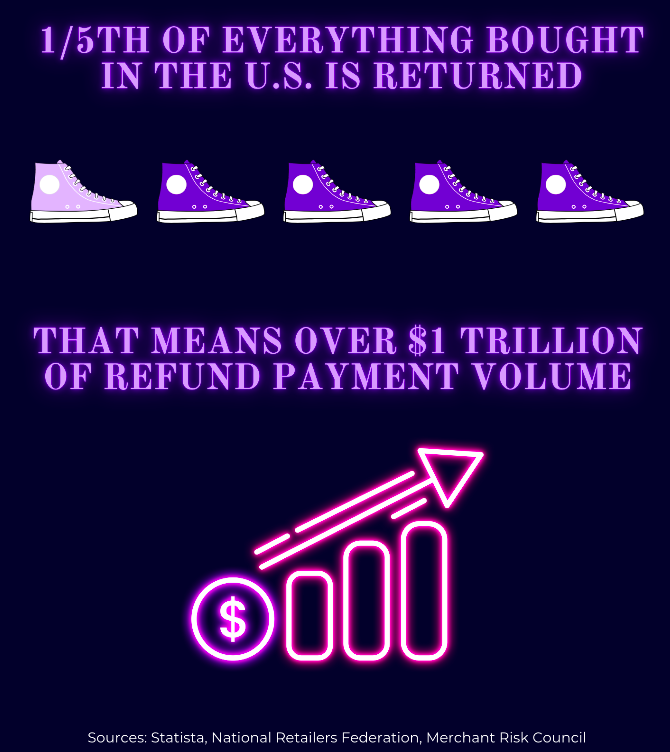

Retailers spent over $700 billion on return-related operations in 2023, and the number is still climbing. Analysts expect this cost to hit $1 trillion by 2030, driven by increasing expectations around instant refunds and automated post-purchase support.

For retailers, it’s a balancing act:

- Fast refunds drive conversion and trust but invite abuse and margin leakage

- Delayed refunds help prevent fraud but create churn when loyal customers feel stalled or distrusted

The real problem is structural.

Most refund policies are one-dimensional, either overly generous or overly strict, and they don’t reflect return behavior, product risk, or customer history. Agents are left guessing or applying blanket rules that don’t scale.

To handle this better, many ecommerce teams are now investing in AI refund decisioning tools. What these systems do is they look at return reasons, purchase history, and customer behavior to trigger the right response, be it an instant approval or applying extra checks where needed.

That means better support outcomes, fewer escalations, and less margin loss, without rebuilding your refund process from scratch.

Before we tread further, let’s look at what instant and delayed refunds mean and how much time and effort go into the refund process.

Instant refunds: Great for CX, risky for margins

Instant refunds feel like a no-brainer: approve the return as soon as it’s initiated, refund the customer right away, and keep them happy.

There are brands that trigger refunds as soon as a return request hits the system to ensure the experience is fast and frictionless.

What are instant refunds?

In an instant refund flow, the refunds are processed the moment a customer initiates a return, either when they submit the request or scan the label. This is mostly done before the item reaches the warehouse and is inspected.

It shortens the refund wait time and ensures the customer gets their money within hours or days, not weeks.

But that speed can cut into margins fast.

The model works well for fast fashion, low-risk SKUs, or VIP customers. However, it starts to break when margin pressure or fraud risk rises.

Why brands choose instant refunds

Beyond meeting customer expectations, instant refunds solve a few persistent ecommerce problems:

- Builds trust and confidence: Fast refunds close the return loop quickly, helping the brand stay top of mind, even if the product didn’t work out.

- Reduces ticket volume: Instant refunds prevent the wave of “Where’s my refund?” follow-ups that usually arrive after a return is shipped.

- Drives reorders: A smooth refund builds goodwill. When shoppers know their money isn’t locked up, they’re more likely to buy again.

The risks of going too fast

Instant refunds shift expectations. In 2023, 41% of customers said they’d pay for instant refunds, favoring a percentage-based fee. That shows how much shoppers now expect speed. But speed, without control, comes at a cost.

Where instant refunds create pressure:

- Refunds before inspection: Approving refunds the moment a label is scanned means the item may never arrive or arrive damaged.

- Erodes margin on repeat: Without visibility into behavior or item condition, you risk refunding customers who shouldn’t get it.

- Makes it easy to exploit policies: Customers who return often, learn to use loopholes, especially when speed is guaranteed.

Delayed refunds: Lower risk, higher friction

Many ecommerce teams lean toward delayed refunds for caution. The idea is simple: don’t issue money until the item is inspected.

It protects margins, filters abuse, and gives finance and CX teams more control. While it helps reduce fraud, it also increases something else: friction.

Let’s look at how delayed refunds impact your support workload, resale cycles, and post-purchase retention.

What are delayed refunds?

A delayed refund is processed only after the return has been received, inspected, and approved. This approach gives the merchant time to validate the product’s condition before money changes hands.

It isn’t just a slower process. It means more work.

Every delayed refund is a potential ticket. When customers don’t see status updates, they contact support. Plus, the longer a return takes, the less value you recover. Even a perfect product loses resale value when it sits in limbo for too long.

Why do brands delay until inspection?

Some teams delay refunds for good reason, especially in categories where returns are frequent or products are prone to wear, damage, or swaps. But what starts as caution soon becomes friction if not handled well.

Why some brands delay:

-

- Validates item condition before refunding: Refunds only go through once the item is checked for damage, wear, or fraud.

- Protects against non-compliant returns: Brands can reject refunds when wrong or worn-out items are returned or when return windows are missed.

- Useful for high-risk categories: In categories like fashion, electronics, and luxury, returns can be high-cost. Delaying refunds protects the margin on high-value items.

Where delayed refunds fall short

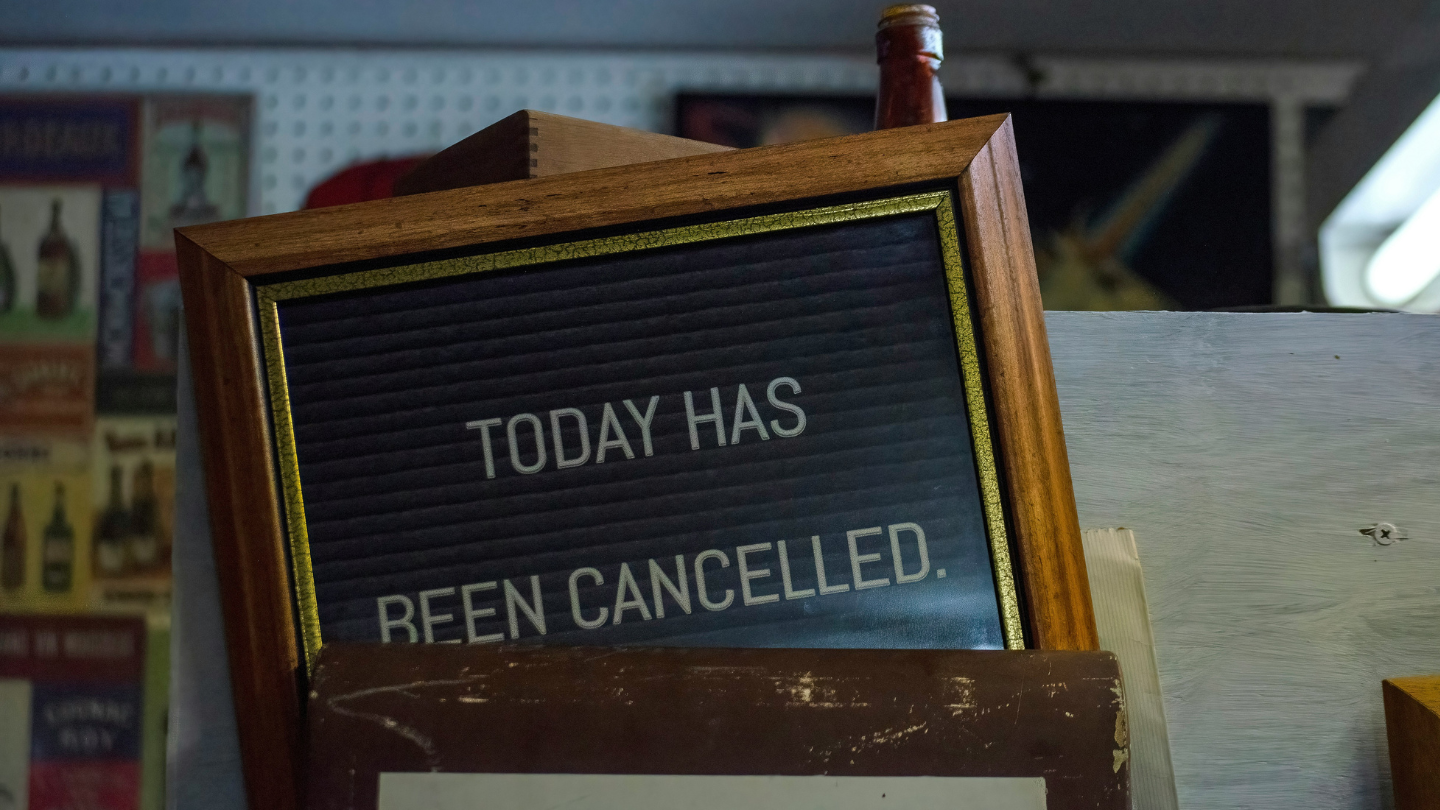

Slowing refunds to reduce fraud may help your balance sheet, but it can backfire fast when customers are left waiting.

The tradeoffs of delayed refunds:

- CX friction: Customers are used to faster refunds. When your timeline lags, trust erodes.

- High refund-chasing volume: Without real-time updates, customers open support tickets (sometimes repeatedly).

- Retention loss: If a refund takes 10+ days, the chance of that shopper returning drops significantly.

- Low resale value: Returned items sit idle longer and may end up missing the resale window for full price.

The true cost of refund processing for merchants

“Why do refunds take time?”

Plenty of brands face this question, and it shows up in refund threads across Reddit.

We’re going to break down what a typical refund process looks like and where it starts draining resources for ecommerce teams.

While refunding a customer may seem like a quick backend action, every step adds time, tools, and cost. Multiply that by thousands of orders, and the burden becomes hard to ignore.

Refund processing: What’s really happening behind the scenes

| Step | Manual effort/time | Tools or systems involved | Hidden cost |

| Return request submitted | Low: Form or portal initiated | Return portal (Loop, Returnly, AfterShip) | No issue yet, but sets the timer for CX |

| Internal validation/eligibility | Medium: Manual rule checks, risk score | Help desk, order system, fraud logic | 2–10 minutes per return if manual |

| Label generated and sent | Medium: Branded returns require setup | Shippo, EasyPost | Small errors lead to delays and added support load |

| Package received at warehouse | High: Scanned, opened, assessed | WMS/3PL/ Shopify or ERP | Inspection delays = refund delays |

| Condition reviewed + refund decision | High: Check for damage, fraud, compliance | Manual, photos, exception queues (Frate) | Often handled by mid-senior agents |

| Refund processed | Low: If rules are clear, high if flagged | Shopify, Stripe, Recharge | Refund time impacts CSAT and retention |

| Communication to customer | Medium: Status updates, confirmations | Help desk, automated email flows (Supermoon) | Delay causes “Where’s my refund?” tickets |

Let’s take the case of an activewear brand on Shopify

This brand processes around 12,000 returns monthly. It runs automated returns through Loop, but all high-value orders still go through manual checks. A lean support team reviews flagged orders, damage photos, and mismatched reason codes.

Every extra minute spent slows the process and costs more than labor. Refund delays strain the support queue and spike repeat tickets. That extra time adds up: to long hold times, frustrated repeat customers, and lower retention.

At the same time, refunds that take too long hurt resale chances. Seasonal items sit unsold, and loyal customers feel punished by a process designed for fraud prevention.

One refund policy doesn’t fit all

Most brands pick a side.

They either build in friction to drive returns down: Ops wins, CX loses.

Or they make it too easy: CX wins, and Ops pays the price.

That might work short term, but a flat policy creates long-term drag. Customers don’t all behave the same. Your refund policy shouldn’t either.

Not all customers deserve the same workflow

A one-size-fits-all return policy treats every customer the same. But high-value buyers shouldn’t be asked to jump through hoops. And serial returners don’t deserve the same benefits.

Here’s how return logic can be more targeted:

| Customer or Order Type | Smarter Refund Approach |

| High-LTV buyer | Pre-approve refund, offer instant credit |

| First-time buyer | Standard flow: verify product scan before refund |

| Repeat returner | Add friction and delay the refund till the item is received |

| High-risk SKUs (e.g., white dresses) | Require inspection before a refund |

| Low-risk SKU (e.g., socks) | Auto-approve once scanned by the carrier |

Flat policies create operational drag

Flat refund rules cost more than they save. They expose you on both ends:

- Over-refunding leads to a loss on low-margin items

- Under-refunding creates churn among high-value customers

- Moreover, manual review slows down resolution and increases support workload

Let’s say a Shopify merchant is facing a growing rate of returns. Their team used a blanket policy with auto-approval for all orders. In three months, they saw a spike in refund fraud and rising complaints from loyal buyers who had to wait longer due to a backlog.

Dynamic refund decisioning changes the game

Retailers no longer need to choose between speed and protection. With refund decisioning AI, you can do both. Leveraging customer behavior, product risk, and historical data, brands deploy flexible refund flows that work best for each scenario.

Doing this helps teams reduce losses, improve service, and maintain trust, all without slowing down the refund cycle.

Refunds tailored to risk, history, and value

Using refund decisioning AI, merchants can adapt their refund process based on customer and product data. For instance:

- Trusted customer, low-risk order: A long-term buyer who never returns items and just purchased a common SKU (e.g., socks) gets an instant refund the moment the return label scans. This rewards loyalty without adding cost.

- New buyer, mid-value SKU: A first-time shopper returning a $60 item is routed through a standard flow—refund only after scan—to maintain a balance between trust and risk.

- High-risk product or flagged account: For a $300 leather jacket being returned by a customer with a history of missing returns, the refund is automatically held until inspection clears.

- Escalation based on tone and pattern: When a customer mentions fraud or files chargebacks with harsh language, the ticket is flagged for manual review. If this matches a pattern of unusual behavior or frequent returns, the system routes it to a senior agent.

How Supermoon helps teams get refunds right

Supermoon doesn’t push refunds through blindly. Instead, it puts all the right information (past refund behavior, LTV, item type, and return reasons) directly inside each ticket. Agents don’t need to bounce between tools or wait for approvals.

With everything visible on-screen, teams can act quickly when it’s safe and pause when there are signs of fraud or repeat returns. This cuts down decision time without sacrificing judgment.

- Decisions backed by refund signals that matter

Each refund request is loaded with context that would otherwise take minutes to gather. These signals reduce the decision time without cutting corners.

- Past refund and return activity

Supermoon shows how many refunds or returns the customer has submitted, how often they’ve been approved, and whether claims were fully resolved.

A history of valid returns builds trust. Patterns like repeated damage claims on different orders are flagged for review. This helps limit margin loss from serial returners without slowing down genuine cases.

- Lifetime value (LTV) and purchase history

High-LTV customers expect (and deserve) faster decisions. Supermoon’s AI surfaces their order count, average spend, and purchase recency inside the ticket. This makes it easier for customer support agents to respond empathetically and favor loyalty without manually digging through order data.

- Return reasons and behavior patterns

The system evaluates if the same return reason keeps showing up across orders or if common fraud triggers are present, like frequent use of “never arrived” claims or generic issues without photo proof. This prevents abuse and protects product margin.

- Sentiment cues to guide tone and urgency

Supermoon reads language cues (“disappointed,” “never ordering again“) and adds a visual indicator (emoji) to the ticket. This helps agents adjust their tone and move faster on urgent cases. It also feeds into smart routing, ensuring frustrated high-value buyers get prioritized while neutral tickets can queue up.

- AI for refund decision support

Brands trying auto-refunds often deal with fraud or accidental overapprovals. Supermoon avoids that trap. It gives your team a smarter inbox where refund decisions are quicker but still grounded in store policy and real customer data.

With Supermoon’s AI Smart Contact Form, customers now get instant answers before reaching an agent, which lowers ticket volume and improves resolution speed.

How refund signals translate to faster action

Once refund indicators are visible inside the ticket, agents can act fast without giving up control. Supermoon gives teams the clarity to move quickly when the data supports it.

- Move faster with trusted customers

When a customer has a clean record, high repeat purchase count, and low return rate, Supermoon brings that context forward at the top of the ticket.

This avoids unnecessary hold-ups and lets the team send a refund or replacement message without chasing extra proof. The system auto-generates replies that are ready to approve, reducing handle time.

The template below can be used when a high-LTV customer reports a one-off issue, like a damaged item, and has a clean return history.

“Hi <first_name>,

I’m sorry to hear your <item_name> wasn’t what you expected. I’ve looked at your order history and see that you’ve been shopping with us for a while; thank you for that. We’ve gone ahead and issued a refund for this item. You’ll get a confirmation email shortly.

Let me know if there’s anything else I can help with.

<agent_name>”

- Reduce back-and-forth while protecting margin

When customers leave out photos, select the wrong return reason, or request something outside policy, Supermoon picks the right template to respond. A template, as shown below, helps agents ask for missing info or clarify the next steps without rewriting them each time.

“Hi <first_name>,

Thanks for reaching out. In order to help with your <item_name>, I’ll just need to confirm a few details. Could you please share the order number and a short note about what went wrong?

Once I have that, I can take the next step right away.

<agent_name>”

- Deliver consistent, data-backed decisions at scale

Every refund decision is recorded with its supporting data. This builds a feedback loop for CX and finance teams. It helps track where policy needs fine-tuning, where abuse might happen, and how much time is being saved per case.

Let your data drive refund calls

Refund speed gets all the attention. But refund decisions are where the profit lies.

- Instant refunds sound great until abuse creeps in

- Delayed refunds sound safe until repeat buyers churn

The sweet spot lies in knowing who you’re refunding and why.

Supermoon gives your team that context right in the ticket: return reasons, flagged trends, past behavior, and customer value.

Whether you’re adjusting return rules by channel or trying to improve the return experience on Shopify, you can now test policies without increasing workload.

Use Supermoon to make refunds smarter, not just faster. Get started and see results in weeks.

Ready to get started?

Don't miss out on the opportunity to leverage the power of AI. Take the leap into the future now!

Try for free