Stop Losing Money on Returns: How to Fight Ecommerce Refund Abuse without Losing Loyal Customers [2025 Guide]

Customers buy items, use them briefly, and send them back in a worn or unsellable condition. Others claim packages never arrived, or they send back empty boxes and expect a full refund. Support teams built to resolve customer issues are now expected to do risk analysis and track fraudulent patterns. How do you stop the fraud without losing your best customers?

Refund abuse has quietly become one of the hidden costs in ecommerce.

Customers buy items, use them briefly, and send them back in a worn or unsellable condition. Others claim packages never arrived, or they send back empty boxes and expect a full refund.

This thread on Reddit has some interesting refund abuse stories.

One user shared how most people buy huge flat-screen TVs from Costco to watch the Super Bowl and return them the next day.

Many of these cases slip past even the most well-meaning support teams because the processes weren’t built to separate good-faith customers from opportunistic ones.

To make matters worse, brands have started issuing refunds the moment a shipping label is printed, long before the item is returned to the warehouse.

They do this as a tradeoff to match Amazon’s level of convenience. Besides, 93% of businesses say that generous return and refund policies are important to attracting and retaining customers.

But those good intentions are now being tested.

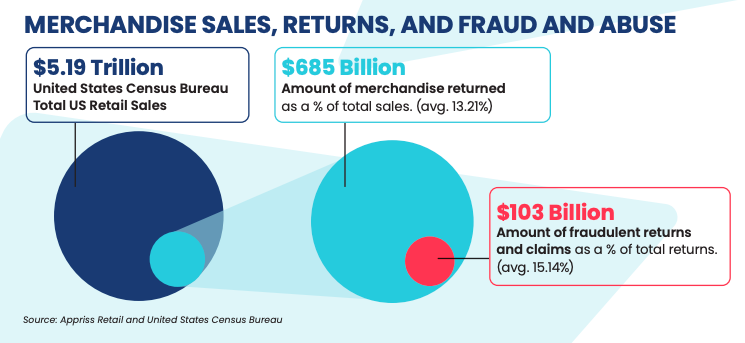

According to research by Appriss Retail and Deloitte, over $103 billion was lost to refund, return, and exchange fraud in 2024. For every $1 billion in sales, US retailers are facing around $145 million in returns.

While some are routine, more of it now ties back to deliberate refund abuse and customers testing how far the rules bend.

Support teams built to resolve customer issues are now expected to do risk analysis and track fraudulent patterns.

Retailers are in a dilemma:

- If they tighten policies (shorter return windows, stricter requirements), they risk hurting honest shoppers and high-value customers

- If they loosen them, they attract repeat abusers

So the question is: how do you stop the fraud without losing your best customers?

This guide shares a practical path forward. We will cover:

- What refund abuse looks like today (and how it’s evolving)

- Why it’s a Customer Experience (CX) problem too

- And no, rigid policies alone won’t solve it

- What you can do instead to protect margins without sacrificing trust

- How to use AI fraud detection for returns and stop bad actors early

- How Supermoon helps brands make better returns decisions in real time

What is refund abuse: A closer look

Refund abuse, also called refund fraud, happens when customers manipulate return policies for personal gain. It includes any behavior aimed at securing a refund under false pretenses (whether or not a return actually happens).

Overall, total returns for the retail industry in the US amounted to $685 billion in merchandise in 2024. Some cases fall into a gray area where customers push the limits of what policies were designed for. Others involve deliberate deception.

As refund fraud schemes grow more sophisticated, it becomes harder for CX and ops teams to spot the difference between a bad delivery experience and a bad actor.

What does refund abuse look like?

Refund abuse isn’t limited to one type of product or buyer. It spans categories, price points, and tactics.

Some of the more common behaviors include:

- Using high-ticket items briefly, then sending them back as unused

- Repeated claims of delayed or lost deliveries to trigger refunds

- Sending back mismatched items in repackaged boxes

- Damaging products intentionally and blaming the brand or shipper

- Filing return claims from multiple accounts to avoid detection

How does it work?

Refund abuse follows a predictable pattern, one that’s hard to catch at scale:

- Identify the target: Fraudsters focus on retailers with refund-on-scan policies or weak return checks

- Place the order: They make the purchase, at times using fake credentials

- Submit a false return claim: Reasons could be: “package didn’t arrive” or “item is defective”

- Get the money: Brands process the refund without confirming the issue

- Repeat: They keep the product or resell it and repeat the scam using new names, accounts, or channels

Some people even justify refund abuse

Many refund abusers don’t think they are doing anything wrong.

A few of their justifications include:

- “It’s a large company. They can absorb the cost.”

- “The item didn’t meet my expectations. I deserve my money back.”

- “There’s no penalty. It’s easy, and I won’t get caught.”

Types of refund abuse

Whether an honest mistake or an intentional move, some common forms of refund abuse include:

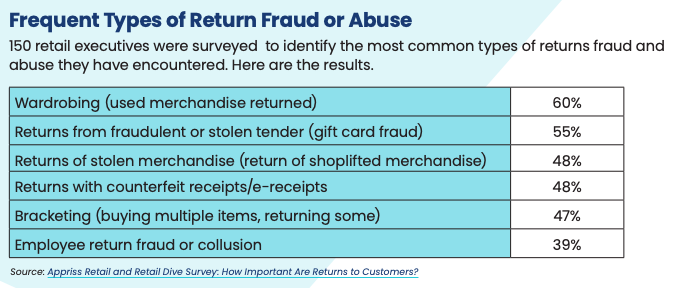

- Wardrobing: By far the most common type of refund abuse, wardrobing involves buying a high-ticket item (apparel, electronics, or even home decor), wearing or using it, and then returning it after use for a refund.

- Bracketing: This is where customers order multiple versions of the same item (either in different sizes or colors) just to try them on and return most of them.

- Item-not-received (INR) fraud: INR fraud looks simple and is one of the oldest refund scams. It is where the customer claims their package never arrived and requests a refund.

- Bricking: In this case, the customer damages the item (either physically or through software tampering) and returns it under warranty or as a defective product.

- Empty boxing: Sending back unrelated or empty packages that pass basic inspection.

- Double-dipping: Filing a chargeback and a refund at the same time.

- Price arbitrage: A buyer swaps the product for a lower-priced item, repacks it, and sends it back. Without careful SKU or serial matching, the fraud passes internal checks, and the refund goes through.

- Refund fraud-as-a-service: Organized scams where third parties run return cons for customers, often advertised on social media. As per this report, a refund fraud ring called “Chin Chopa,” operating on Telegram, scammed retailers of millions by stealing over 10,000 items since 2023.

Why refund abuse is a CX problem, too

Bad actors are getting smarter, but most brands are still guessing. 84% of merchants find abuse hard to crack down on.

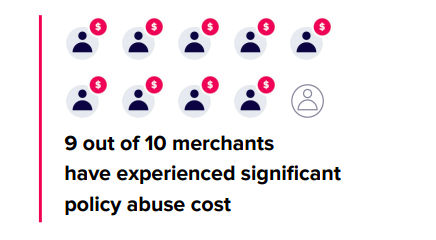

It is also starting to weigh down merchants, with 9 out of 10 of them feeling the pressure of significant costs from policy abuse.

Most brands think of refund abuse as a fraud or margin issue. But over time, as brands respond with stricter controls, it also becomes a CX problem, one that slowly chips away at trust, increases churn, and puts pressure on support teams to choose between fairness and protection.

Refund abuse quietly breaks trust and drains margins

Your support team may not have the full view of customer behavior, owing to which policies stay broad and cautious, punishing everyone to catch the few who cheat the system.

This creates two kinds of loss:

False positives, where good customers are flagged or delayed, resulting in them feeling accused, mistrusted, and stuck in a slow, inflexible return process. This further erodes post-purchase confidence, resulting in shoppers second-guessing returns.

On the flip side, false negatives let repeat abusers slip through undetected. With time, these losses push up the Cost of Goods Sold (COGS), drive excess fulfillment work, and overwhelm CX teams with manual reviews.

For many customers, the return is the last interaction with the brand, and if that moment feels hostile or unfair, they may leave you forever.

The Appriss Retail and Deloitte research also revealed that:

- 55% of shoppers said they have walked away from a purchase owing to strict return terms

- Even worse, 31% said one bad return experience was enough to stop shopping entirely

Return policies shape loyalty, often by accident

If the returns process feels harsh or impersonal, it leaves a lasting impression that hurts long-term customer loyalty.

Customers pay close attention to how easy it is to send something back, how fast refunds are processed, and how well they are treated during the process. They also feel the pinch when the return policies tighten, when refunds slow down, or when they have to prove their honesty to get their money back.

The problem is that most refund policies are static; they treat every buyer the same, and customers notice when they are treated like a number.

This is how “defensive CX” takes root.

Support teams (tired of dealing with refund abuse) start defaulting to saying “no.” Instead of helping customers, they are forced to police them, second-guessing claims, requesting extra proof, or rejecting valid refunds.

So, a loyal customer returning a $400 item feels penalized, while a cautious buyer comparing two similar brands chooses the one with more lenient terms.

Policies alone won’t fix refund abuse

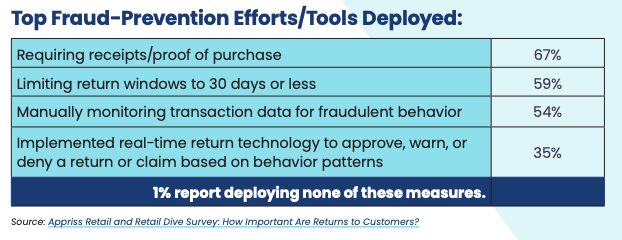

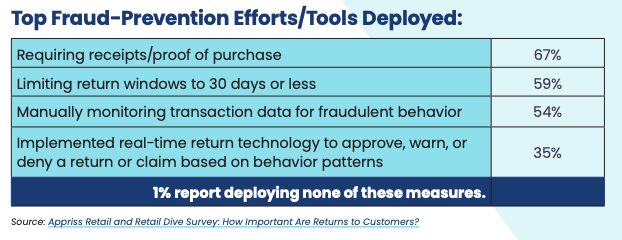

As refund abuse climbs, merchants are locking down return and refund terms.

What used to be a CX asset, fast, flexible returns, is being reversed to plug revenue leaks.

Faced with repeated refund manipulation, margin loss, and rising costs, 84% of retail leaders say they have had to modify policies to counter fraud.

A recent report also stated that:

- One-third of retailers charge fees for returned items

- Another third offers only store credit or exchanges

- Two in five ecommerce brands give just seven days to file a return or refund claim, down from the 30-day norm in brick-and-mortar retail

These changes start as fraud prevention measures but chip away at buyer confidence.

-

Blanket rules frustrate real buyers

Return limits hit high-intent shoppers first. Shorter windows, restocking fees, or unclear policies introduce risk into the buying decision. Buyers hesitate to purchase full-price items or multiple variants. This results in higher cart abandonment and lower reorders.

-

Manual fraud review isn’t designed for ecommerce speed

Support teams are under pressure to catch refund abuse. But most lack tools that unify order history, return frequency, and past interactions in one view. That means agents spend hours cross-referencing spreadsheets and dashboards just to validate one case.

How to protect margin without sacrificing trust

Refund abuse hides in patterns that blend in with everyday behavior. And yet, most fraud prevention measures fixate on blocking bad behavior with outdated defenses: manual order reviews, receipt checks, and flat rules that block good customers alongside bad ones.

Teams that win are the ones that separate intent from noise and respond with control. They layer controls across the journey, look at patterns in context, and use real-time decisioning to manage risk without adding unnecessary friction.

-

Detect serial refunders early in the journey

Return abuse is easiest to control when it’s flagged early. The key is knowing what to watch.

Start tracking:

- High refund frequency tied to a single category or SKU

- Short gaps between purchases and return requests

- Accounts that initiate returns after coupons or sitewide offers

- Unusual velocity from new accounts or one-time buyers

- Disputes raised soon after delivery confirmation

Here’s a sample of signals and possible outcomes.

| Signal Type | Description | Common Next Step |

| Refund frequency | 3+ refunds on similar SKUs in 60 days | Flag for review, limit future auto-approvals |

| Account metadata | Recently created, high-value orders only | Hold high-ticket items before shipping |

| Geo + order cluster | Multiple orders from the same area/device | Link activity and assess coordinated behavior |

| Coupon abuse pattern | Stack discounts and return partial order | Restrict coupon stacking on flagged accounts |

-

Uncover hidden accounts and synthetic behavior

Some refund abusers don’t stick to one name or device. They use fake emails, new addresses, and even reroute deliveries to mask behavior.

To break the loop, build a detection layer that connects the dots:

- Group accounts by device fingerprint or IP

- Flag coordinated refund timing across aliases

- Identify shared delivery addresses or payment methods

- Link purchases with an unusual combination of geolocation and order behavior

-

Use real-time decisioning at every touchpoint

Most CX teams start a fraud review when a return ticket lands in the inbox. By then, it’s already too late.

Build checks across the funnel and embed decisioning earlier, from account signup to checkout to refund request:

- At signup: monitor for synthetic account patterns

- At checkout: flag high-risk behavior based on order metadata

- Post-purchase: allow fast returns for trusted buyers, but queue suspicious ones

-

Offer store credit instead of cash when appropriate

Refunds don’t always have to mean revenue lost.

- In categories where returns are high (like fashion, gifting, or seasonal products), offering store credit helps retain future value while meeting customer needs

- Use store credit to re-engage one-time buyers with future incentives

- Pair credit with time limits or SKU restrictions for better control

-

Tailor your refund strategy to your risk profile

Refund risk varies by brand, product type, and customer behavior. Your return policies should reflect real-world behavior as shown below.

| Brand Type | Common Abuse Pattern | Suggested Control |

| Fashion/DTC Apparel | Wardrobing, bracketing | Stricter return inspection, limited return window |

| Subscription Boxes | “Missing item” claims | Order confirmation with photo verification >> use tools like Frate |

| Gifting and Seasonal | Last-minute returns post-event | Shorter return window, store-credit default |

| Health and Personal Care | Open-item return attempts | No-return SKUs, refund cap policies |

-

Make decisions based on data, not instincts

Your team shouldn’t have to guess who’s honest. And your policies shouldn’t change based on who answers the ticket.

- Use structured order, sentiment, and ticket history data to guide approvals

- Train teams on how to read behavioral trends, not just isolated tickets

- Build consistency to ensure customers aren’t penalized or rewarded based on which agent they get

- Create fair policies that are explainable and grounded in facts

AI’s critical role in stopping ecommerce refund abuse

On average, retailers lose 60% of the item’s value on every return, even when they recover the product.

Apparel retailer PACSUN flagged over $24,000 in returns from a single customer across 250+ orders. To safeguard against the growing tide of refund abuse, ASOS has begun deactivating serial returners, while Zara, J.Crew, and Uniqlo now charge for returns.

As seen earlier, mere policy shifts won’t help. Brands need to be armed with real-time context, pattern detection, and flexible logic. That’s where AI comes in. It helps you keep loyal buyers in the system while blocking abuse.

Here’s a look at how AI helps you respond before the damage is done:

Detects abuse patterns before refunds stack up

AI doesn’t wait for chargebacks or support tickets. It acts as behavior unfolds by:

- Flagging refund frequency, return speed, or repeat low-rating orders

- Linking orders by device ID, IP address, or shipping details to flag fake accounts or account cycling

- Surfacing high-risk SKUs, repeat offenders, and coordinated refund rings using behavioral data

Automates low-risk refunds to reduce workload

Most refund requests aren’t fraudulent but still take time. AI filters out the noise and handles what’s predictable.

- Auto-approves returns for sizing issues or shipping delays

- Applies thresholds by order value, purchase history, or item category

- Reduces decision fatigue for agents and speeds up refunds, especially for loyal customers

Uses context-aware logic for fairer decisions

AI puts the full customer picture in front of your team, not just the latest ticket.

This allows CX teams to:

- View LTV, purchase history, and refund frequency side by side

- Adjust refund logic for VIP customers or known high-value accounts

- Avoid rigid rules that penalize loyal buyers or create unnecessary support friction

| 💡 Tip: Use tools like Supermoon to make refunds quicker and more efficiently. |

How Supermoon powers smarter returns decisions

Supermoon equips CX teams with the context they need to decide quickly, fairly, and accurately, especially in high-risk or unclear cases.

With Supermoon, support agents can make smarter decisions using real-time data across refund history, sentiment, and account behavior—all in one view.

What does Supermoon bring to every refund decision?

- Makes returns context-rich, not policy-blind: Every refund request shows up with full context: purchase history, sentiment, and previous communication, helping agents spot good intent or abuse.

- Uncovers refund themes and reduces support load: Supermoon analyzes refund-related tickets and incoming email patterns so CX leads can see what issues are rising, whether it’s sizing, delivery timing, or product quality. With auto-replies and templates for common questions, teams save time and keep the ticket queue smoother.

Make the right refund calls with Supermoon

Supermoon helps ecommerce ops teams tackle refund abuse without hurting loyal buyers. It weighs sentiment, history, and value before the agent hits “approve” or “deny” for a refund request. That means smarter refund policy optimization and fewer losses to serial returners in ecommerce.

Use Supermoon to cut refund abuse, spot serial returners, and keep return policies working as intended. Sign up here.

Ready to get started?

Don't miss out on the opportunity to leverage the power of AI. Take the leap into the future now!

Try for free